Analysis: Wayfair’s model is deeply unprofitable

Wayfair ends its fiscal year on a downbeat note, proving once again that it is incapable of operating its business profitably.

In the final quarter, the company had a net loss of $330 million, bringing the total loss for the year to an eye-watering $985 million – just shy of the billion-dollar mark. In our view, this is quite extraordinary, especially as it means losses have almost doubled since the prior year.

The issue we have with Wayfair is that there is no clear path to profitability. That the company has a $1.5 billion long-term debt pile which costs it about $54 million a year in interest is bad enough. But on top of this, its operating metrics are incredibly weak and do not even hint at the business being sustainable. Taking out advertising costs, at operating level Wayfair made a $5.4 million operating profit this quarter; nowhere near enough to cover the interest payment on its debts.

However, the situation is worse than this because of the amount Wayfair spends on advertising. This quarter advertising expense came to $310.9 million, bringing the total spend for the year to $1.1 billion. This exceptional level of cost puts an enormous hole in profits at operating level and means Wayfair is deeply unprofitable.

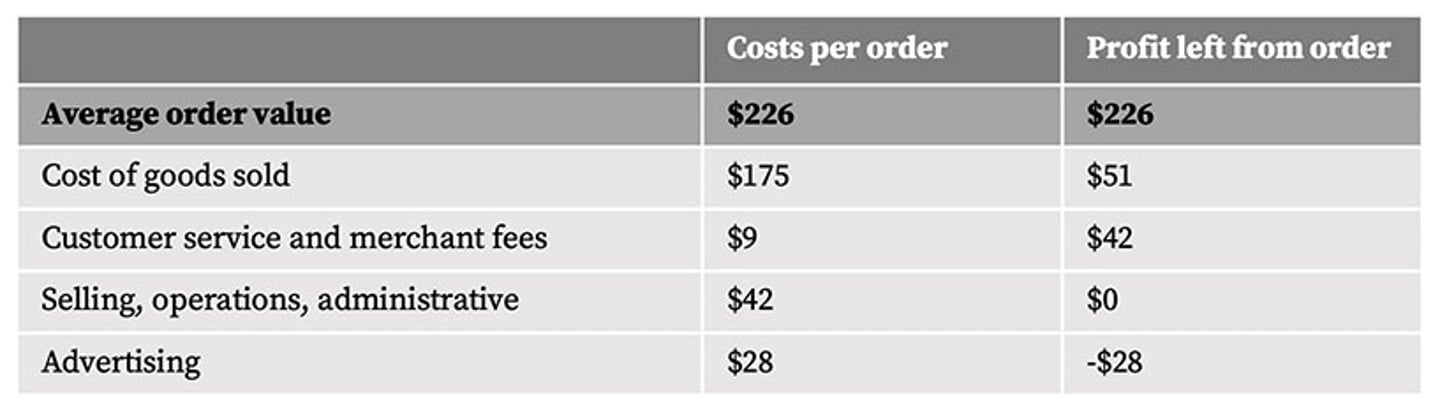

The math behind this all makes for unattractive reading:

Basically, even without advertising, Wayfair’s model generates no profit; with advertising it is plunged into the red. And spending $28 on advertising per order, which amounts to over 12% of the order value is, in our opinion, absurd.

Wayfair now seems to recognize that it needs to square the circle which is one of the reasons it recently announced it was laying off 550 employees or 3% of its global workforce. However, as well-intentioned as this move is, we do not believe it will push Wayfair into the black. The problem isn’t that staffing costs are too high per se. The problem is that the whole business model is built on unsound foundations.

Even more worrying is the fact that there is now a clear trend of slowing growth. Admittedly, Wayfair is still very impressive at generating revenue and is growing at a pace that would be the envy of most retailers, however, with advertising costs rising and losses mounting it would be reasonable to expect the pace of sales growth to at least be maintained. That this isn’t the case will exert further pressure on the bottom line. Should there be a more serious downturn in demand from either a recession or an escalated coronavirus crisis, we believe the impact could be catastrophic for Wayfair.

No one denies the necessity of advertising and marketing to attract customers, especially for a category that is infrequently purchased. Equally, no one would deny that online furnishings is a hard business with relatively thin margins. However, others have made it work. Sadly, Wayfair has not. And it does not appear that it will do so any time soon.