-

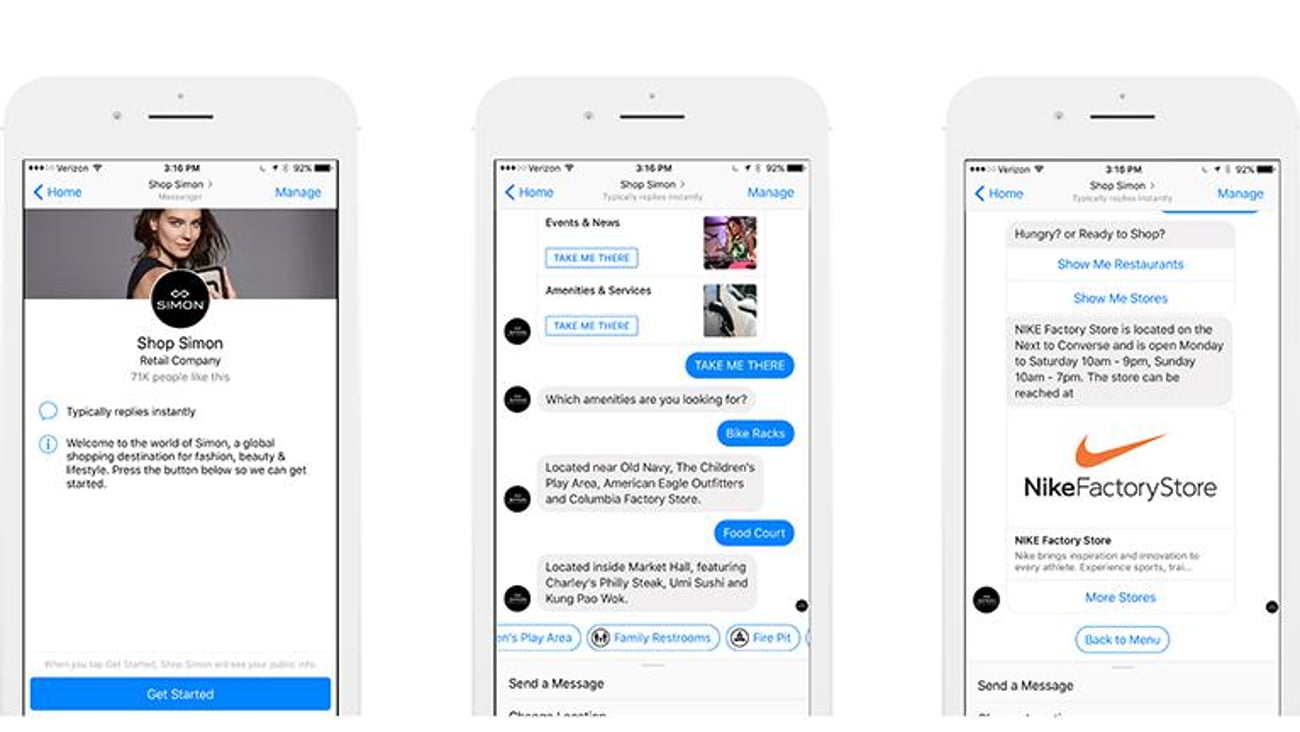

Simon launches ‘concierge bot’

Simon is debuting a new type of concierge — one that never calls in sick. The mall owner launched a chatbot designed to deliver customers at its 208 North American centers useful information as they shop. Described as the industry’s first enterprise-wide bot, the artificial intelligence-based technology is available through Facebook Messenger, and provides store and restaurant information, hours of operation, special events, daily promotions and a list of available amenities. -

Abercrombie & Fitch continues rollout of new store prototype

Abercrombie & Fitch Co. has brought its updated store environment to Tysons Corner Center, Tysons, Va. The location is one of seven new concept stores the retailer will open by yearend. Abercrombie debuted the new look in February, at Polaris Fashion Mall in Columbus, Ohio. It has also opened at Lenox Square, Atlanta, Georgia, and at Somerset North, Troy, Michigan (Somerset North).