How retailers addressed back-to-school demand

Traditionally, the back-to-school season has started the hot business period in retail.

Yet, unlike all the previous years, the 2021 back-to-school was expected to be anything but traditional for retailers. For example, the National Retail Federation projected the total shopping spending during the season to reach $37.1 billion (an increase of 7.5% YoY, compared to $33.9 billion in 2020).

Besides the exciting financial performance, the retail association highlighted the most popular product categories that school shoppers would spend their particular attention and savings on: electronics ($12.9 billion), clothing ($11.1 billion), shoes ($7.0 billion). Deloitte confirmed the projections by estimating a 37% year-over-year growth in tech products sales and a 42% uptick in COVID-19-related product sales. The respondents also anticipated a COVID-19-following shortage of items on the shelves, so they shared plans on wrapping back-to-school shopping earlier this season.

Now, as the first school bell has rung its tribute to the parting summer and welcomed school goers to the class, it's high time to evaluate how retailers navigated through the hot shopping season and made a profit from the back-to-school craze.

A thorough study of the activity of 11 global retailers during the back-to-school season 2021 has revealed some trends that confirm or bust the thrill of projections.

Early product shortage

The pool of retailers selected for the observation had cumulative 111 product sub-categories under the "back-to-school' category. This number equaled a total of 8,367 items.

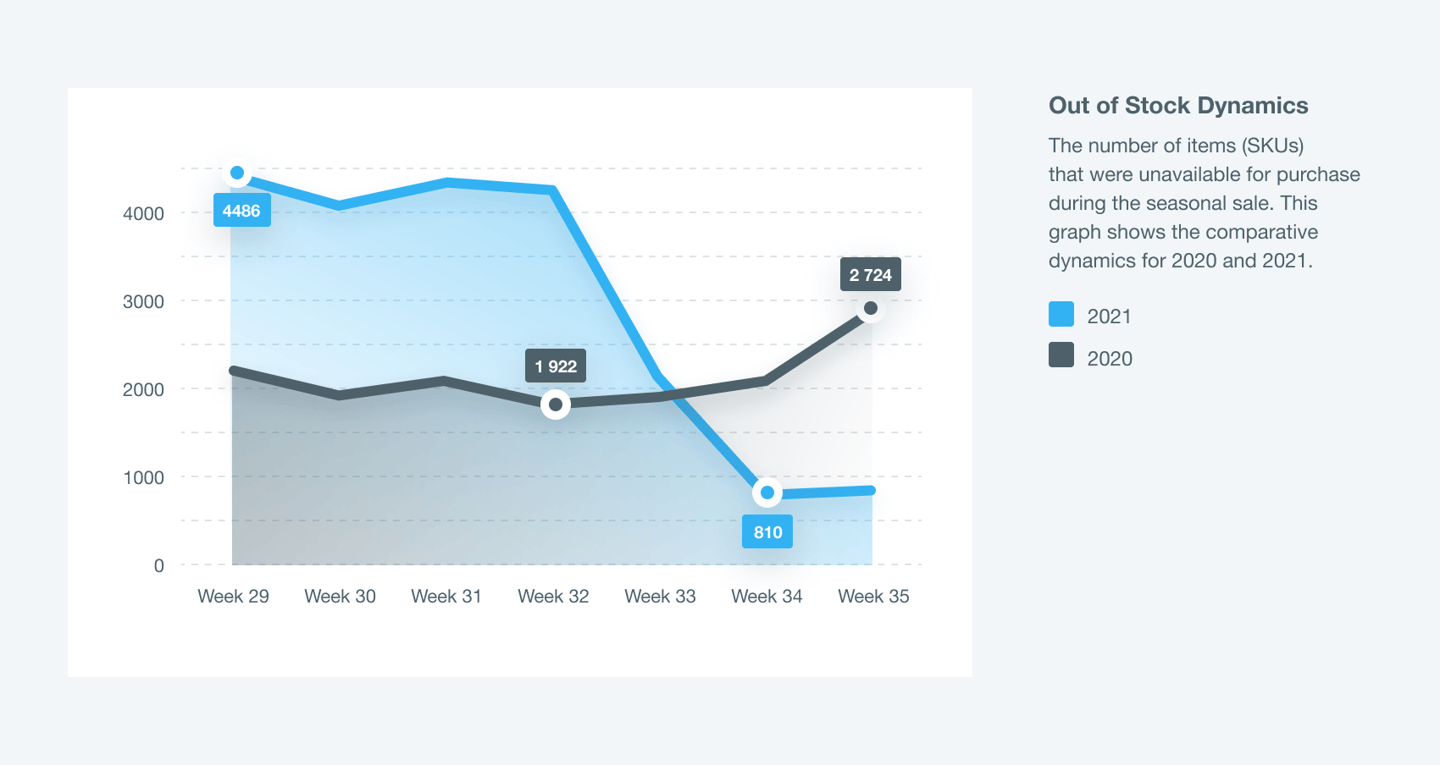

From mid-July to the beginning of August, the retailers' stocks were half empty as 4486 items were swept off the shelves. And it was only by the end of August that retailers restored their stocks to tackle the demand properly.

The finding confirmed Deloitte's forecast and went in contrast to the 2020's inventory sellout dynamics. A rather smooth inventory sellout marked the same time period in 2020.

Promo rush

To seize a lucrative share of the projected back-to-school spend, retailers resorted to introducing promo for the school-related assortment. As a result, the maximum product share on promo in 2021 reached the 94.2% mark at the beginning of the season, and 91,1% of products at minimum went off at a discounted price as the back-to-school shopping season was in full swing.

Product mix

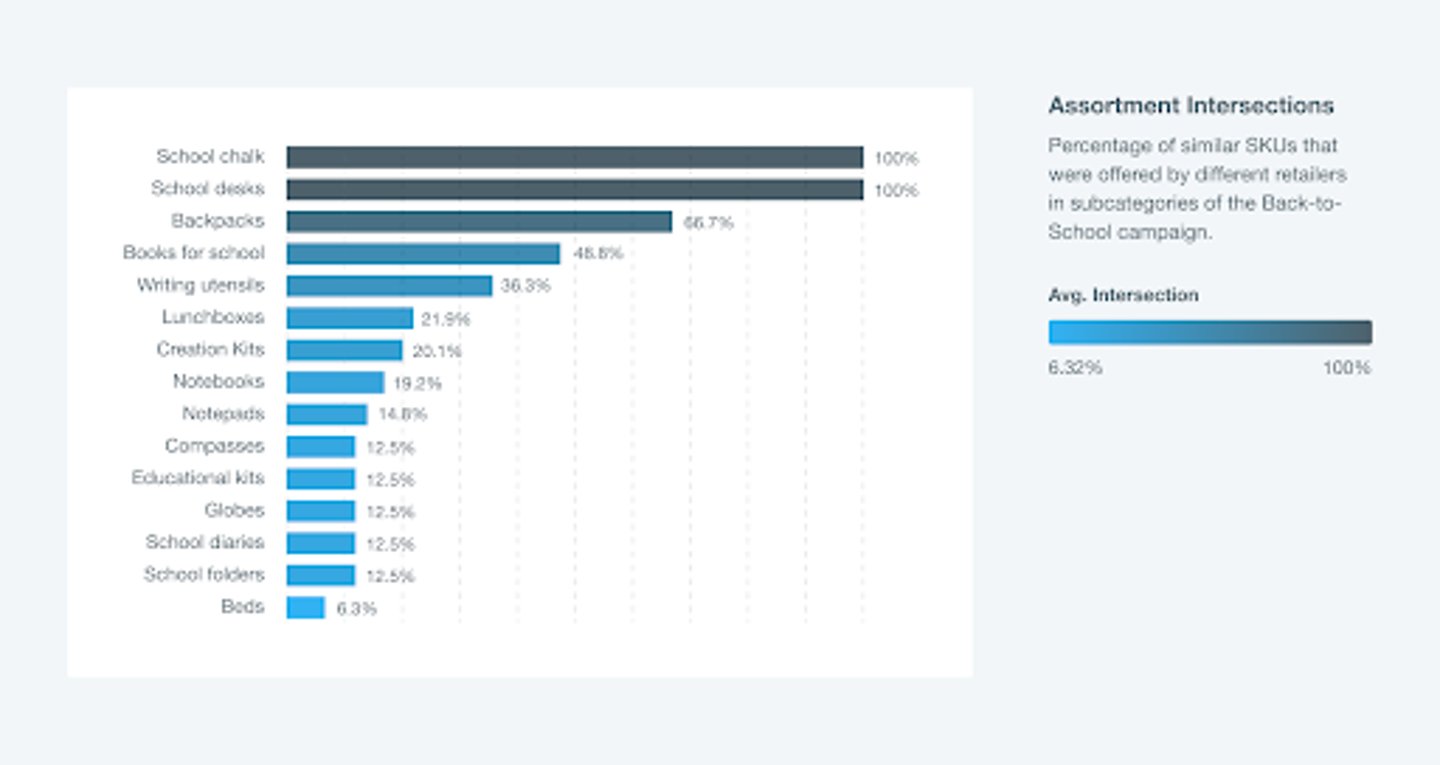

Versatile as it can only be, the 'back-to-school' product category differed from competitor to competitor. Yet, the study revealed the most common sub-categories and the assortment share that retailers have in common for a particular sub-category. Let's review in detail:

Discount amount and frequency

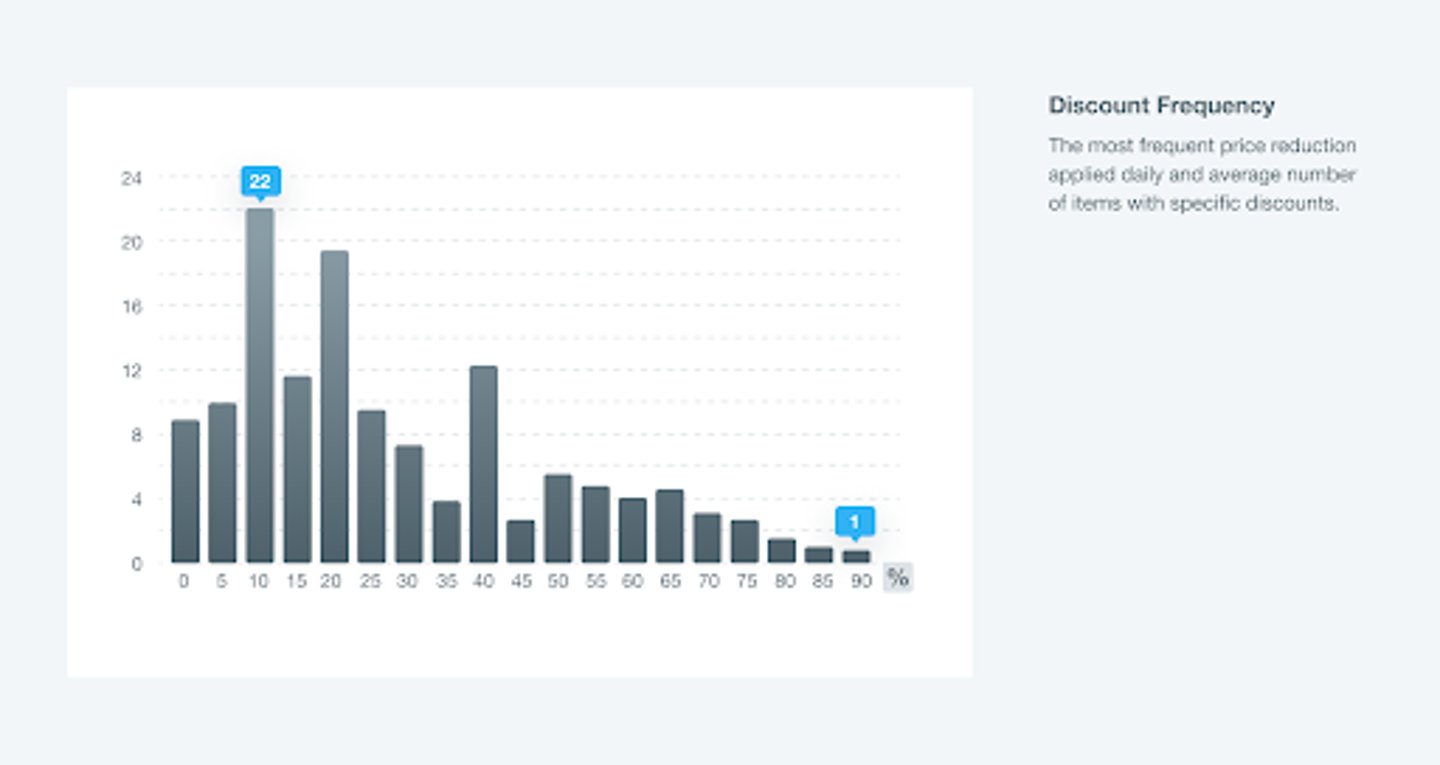

As we have already found out, discounts have been an integral part of this shopping season. But what kind of discounts are referred to here and how often were they applied? Statistics showed that 10% was the most frequent price reduction applied daily to 22 products (on average) by retailers.

The 20% discount comes next in the popularity chart with 19 products offered to buyers. And 40% wraps up the top-3 chart as it was applied to 12 products in a retailer's back-to-school portfolio daily.

Best Deals

While 10%, 20%, and 40% discounts were overwhelmingly flooding the shelves, there were some absolute winners among the promo offers: Erich Krause Classic Pen 3pc sold out with an 83% discount and 12-sheet school notebook at a price reduced by 93%.

And the top three products with the minimum price were:

- 12-sheets A5 Notebook - $0,012

- Erich Krause Ballpoint pen automatic blue 0.7mm - $0,035

- IQ 3D Puzzle "Bear with flowers" - $0,2

Moderate discounts

Unlike the above-mentioned two items, the following products went off at the most limited discount during the shopping season: Hatber Eco Notebook and Coloring board #1(8 sheets, 8 colors) were appealing to buyers with a 3% discount each.

The TOP 3 high-priced products in retailers' "Back-To-School" category were:

- Herlitz Flexi Formula Plus Backpack - $213,04

- Lego Friends Heartlake City Hair Salon - $189,37

- Polini Kids Simple Bed - $137.39

Back-to-school promos: 2020 vs. 2021

Just as any hot season in retail, this year's back-to-school didn't go without extensive promos. Retailers, armed up with the projections on the increased demand and shoppers' appetite, were up and doing to craft the most appealing offers and get a good share of the projected shopping spend. To get the full picture of how diligently they pursued sales, let's review the numbers presenting retailers' back-to-school assortment on promo:

Summing up

This year's back-to-school season has been especially ripe in retail opportunities. With the projected $37.1B in total spending on class-related products, retailers were up and doing to craft attractive promo offers and seize a share of the intended spend.

Traditionally, it didn't go without ripe discounts and irresistible promo offers, which in some cases reached 93% and 83%. However, compared to 2020, this season's dynamics and timeline broke the traditional pattern, thus giving retailers another reason to rethink their traditional approaches to procurement, assortment planning, and merchandising.