Analysis: Where are back-to-school shoppers spending?

One channel still represents a significant share of back-to-school spend.

According to analysis of $2.4 trillion in 2018 back-to-school purchase data from Cardlytics, a company that powers a native ad platform for marketers in banks’ digital channels, 79% of all back-to-school spending occurs in brick-and-mortar stores. Another 17% occurs at online-only e-commerce retailers, while 4% occurs at e-commerce sites of brick-and-mortar retailers.

Although brick-and-mortar clearly dominates back-to-school spending, the channel’s share of all brick-and-mortar spend dropped by 2.6 percentage points year-over-year, while the share of online-only retailers grew by 2.3 percentage points and the share of brick-and-mortar e-commerce sites rose by 0.3 percentage points.

In another positive sign for the long-term future of online back-to-school shopping, spending was flat at brick-and-mortar stores but up 20% at online-only e-commerce retailers (including Amazon) year-over-year and 31% at brick-and-mortar e-commerce sites. Compared to single-channel back-to-school customers, omnichannel customers drove 48% of spend and 48.1% of purchases.

Examining back-to-school sales by category, Cardlytics found multiline retailers (including Amazon) captured 74% of spend, followed by apparel (12%). The remaining share was divided among retailers in the home décor (4%), office supplies (4%), sporting goods (3%) and shoes (2%) categories.

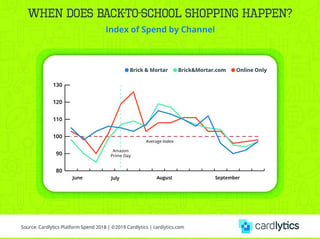

In terms of when back-to-school shopping occurs via different channels, Cardlytics data indicates that back-to-school spend at online-only retailers peaks in late July, shortly after Amazon Prime Day. Meanwhile, brick-and-mortar spend has two peaks in early August and early September, while spend at brick-and-mortar e-commerce sites peaks in early August. Spend in the brick-and-mortar and brick-and-mortar e-commerce channels craters in early September and then slightly rebounds, while spend in the e-commerce channel dips in both early and mid-September before also having a small resurgence.

Cardlytics data also suggests retailers should be targeting back-to-school shoppers for the upcoming holiday season. The average spend per customer acquired during the back-to-school season at top holiday retailers is $163, compared to $132 for customers acquired during the holiday season.

According to analysis of $2.4 trillion in 2018 back-to-school purchase data from Cardlytics, a company that powers a native ad platform for marketers in banks’ digital channels, 79% of all back-to-school spending occurs in brick-and-mortar stores. Another 17% occurs at online-only e-commerce retailers, while 4% occurs at e-commerce sites of brick-and-mortar retailers.

Although brick-and-mortar clearly dominates back-to-school spending, the channel’s share of all brick-and-mortar spend dropped by 2.6 percentage points year-over-year, while the share of online-only retailers grew by 2.3 percentage points and the share of brick-and-mortar e-commerce sites rose by 0.3 percentage points.

In another positive sign for the long-term future of online back-to-school shopping, spending was flat at brick-and-mortar stores but up 20% at online-only e-commerce retailers (including Amazon) year-over-year and 31% at brick-and-mortar e-commerce sites. Compared to single-channel back-to-school customers, omnichannel customers drove 48% of spend and 48.1% of purchases.

Examining back-to-school sales by category, Cardlytics found multiline retailers (including Amazon) captured 74% of spend, followed by apparel (12%). The remaining share was divided among retailers in the home décor (4%), office supplies (4%), sporting goods (3%) and shoes (2%) categories.

In terms of when back-to-school shopping occurs via different channels, Cardlytics data indicates that back-to-school spend at online-only retailers peaks in late July, shortly after Amazon Prime Day. Meanwhile, brick-and-mortar spend has two peaks in early August and early September, while spend at brick-and-mortar e-commerce sites peaks in early August. Spend in the brick-and-mortar and brick-and-mortar e-commerce channels craters in early September and then slightly rebounds, while spend in the e-commerce channel dips in both early and mid-September before also having a small resurgence.

Cardlytics data also suggests retailers should be targeting back-to-school shoppers for the upcoming holiday season. The average spend per customer acquired during the back-to-school season at top holiday retailers is $163, compared to $132 for customers acquired during the holiday season.