PayPal expands buy now, pay later offerings

PayPal Holdings Inc. is enabling U.S. consumers to spread payments out over longer periods of time.

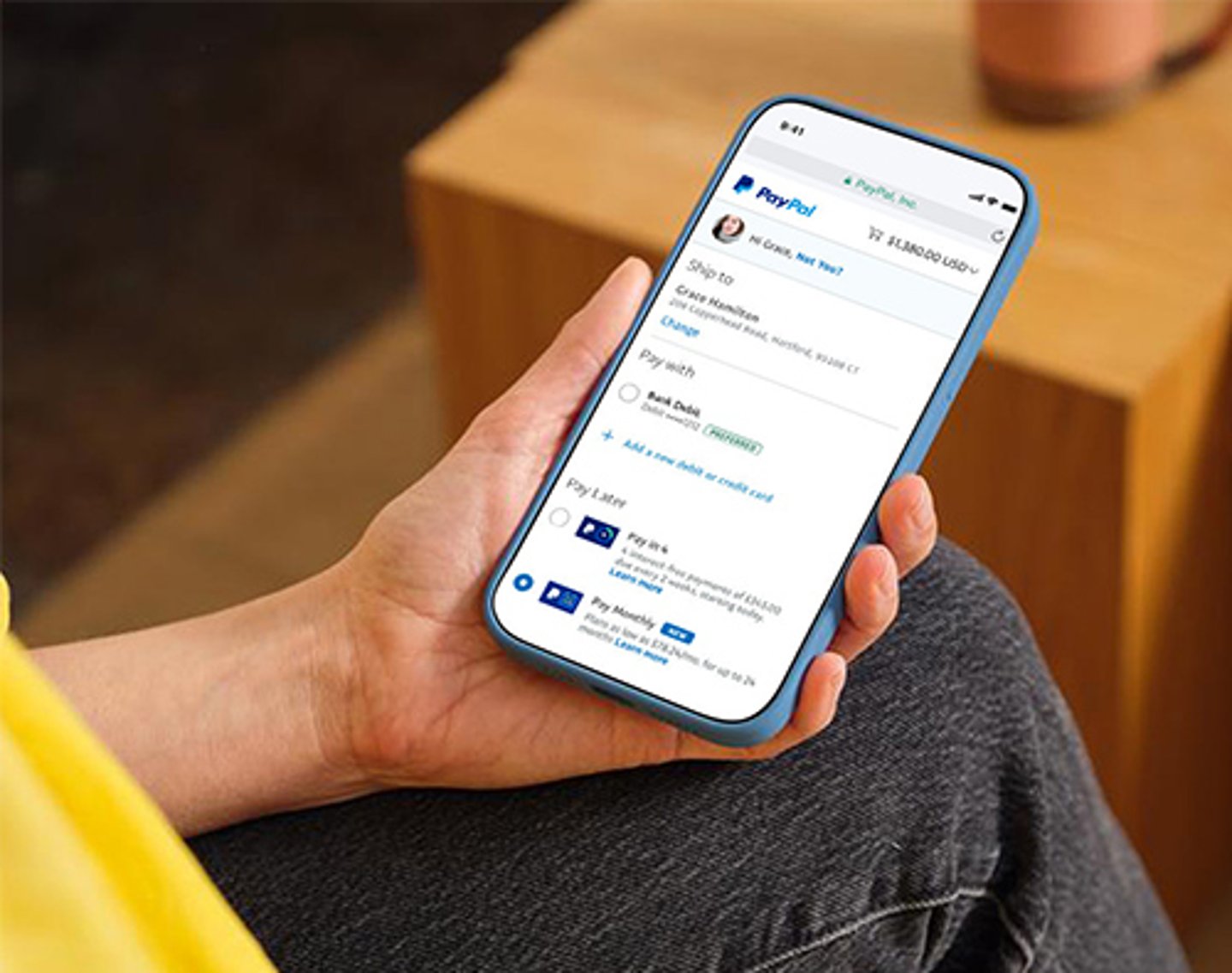

The digital payment platform is introducing a new buy now, pay later (BNPL) solution called PayPal Pay Monthly, issued by WebBank. Pay Monthly enables customers to make large purchases between $199-$10,000 and break the total cost into monthly payments over a six–to-24-month period, with the first payment due one month after purchase.

Instead of paying the full price of a purchase outright when checking out with a credit or debit card, BNPL enables shoppers to break the total purchase into smaller payments, often without interest, that can be billed to a personal account.

Once a customer selects Pay Monthly, they will complete an application at checkout and, if approved, will be presented with up to three different plans of varying lengths, with risk-based annual percentage rate (APR) ranging from 0%-29.99%.

BNPL products offered through PayPal, including Pay Monthly and PayPal Pay in 4, have no late fees and allow consumers to choose their repayment method and select automatic payments up front when completing their transaction. With Pay Monthly, customers can select between using their debit card or bank account for repayment and manage and track payments through the PayPal app and online.

Pay Monthly purchases are backed by the PayPal Purchase Protection buyer security program. Customers will have the option to select Pay Monthly at millions of retailers, including brands like Outdoorsy, Samsonite, Fossil, and Advance Auto, by summer 2022.

Pay Monthly will be automatically available for retailers at no additional cost or risk, and requires no complex back-office integration to add as a payment option. Similar to Pay in 4, retailers can also add dynamic messaging to deliver relevant Pay Later options that are presented early in the customer’s shopping experience to let them know they will have the option to spread out payments at checkout.

Initially offered by specialty flexible payment platforms such as Klarna and Afterpay, BNPL offerings have more recently sprung up from established payment providers such as Mastercard. Apple is also releasing a BNPL service called Apple Pay Later as part of several new upgrades to its Apple Wallet mobile wallet solution.

In addition, advertising platform StitcherAds recently introduced Flexible Payment Promotions, a solution that enables retailers to promote buy now, pay later (BNPL) installments across ad units on Facebook, Instagram, Pinterest, and Snapchat. According to data from eMarketer, more than 45 million U.S consumers (ages 14 and older) used a BNPL platform in 2021, up 81.2% over the previous year.

“How consumers look to pay for larger purchases is evolving and there is a growing demand for flexible payment options with 22 million PayPal customers using our pay later offering this past year,” said Greg Lisiewski, VP of Global Pay Later Products at PayPal. “Pay Monthly builds on our commitment to deliver leading payment solutions that offer customers choice to ensure checkout matches their needs and budgeting preferences.”