What’s in store for ’08: Top trends to watch

NATIONWIDE RT REPORT—Uncertainty is the retail industry’s constant companion, thanks to shifting market conditions and fickle consumers that require operators to continually modify strategies if they are to remain relevant, grow and improve profits.

Achieving those objectives is challenging enough when healthy economic conditions, stable operating costs and confident consumers provide a clear view of future business trends. When such clarity does exist, financial executives and investment analysts are able to forecast sales and profits with a remarkable degree of precision.

Now is not one of those times. The New Year begins with a glut of housing inventory, declining prices and little evidence to suggest when balance will be restored. Meanwhile, consumers are experiencing food price inflation and energy prices are expected to remain volatile, thanks to a war in the heart of the world’s major oil producing region and resulting geopolitical instability. These macroeconomic headwinds, to borrow from the jargon glossary of the financial community, are compounded by the specter of uncertainty raised by presidential candidates as they debate how they plan to fix what ails the nation.

With so many factors clouding the outlook for the economy, the business climate and the consumer spending environment for retailers, it is little wonder investors shunned retail stocks last year.The S&P Retail Index, a subset of the 34 largest publicly traded retail companies contained in the S&P 500 Index, spent the first half of the year above the 500 mark, but headed south in the second half of the year and by late December was slightly above the 400 mark.

Forced to operate in an environment full of forces beyond their control, the editors at Retailing Today determined that success in 2008 will be achieved by those companies focused on the following:

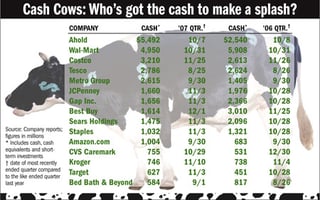

Financial flexibility: A solid credit rating and healthy balance sheet will serve retailer industry leaders well during 2008 as they again demonstrate why cash is king. With expectation high that consumer spending will be constrained by economic weakness and tight credit, especially during the first half of the year, the industry’s marginal players are in for a tough time. Those companies who struggle to grow sales, even when economic growth is robust, will increase borrowings under their credit lines, if they haven’t already done so, to fund operations. Meanwhile, prudent operators with proven business models will be able to repurchase shares at attractive levels because investors have shied away from the retail sector, reward patient shareholders with increased dividends or make opportunistic acquisitions of distressed companies forced to explore strategic alternatives.

Perceived value: Retail in affluent economies is an emotion-filled business where purchases are driven by consumers’ desires to satisfy wants, rather than simply meet needs. As such, the depressing psychological impact of the housing situation has been understated by Wall Street experts out of touch with residents of Main Street, who are experiencing and witnessing firsthand the situation with foreclosures and un-sold inventory. In an environment where consumers have a lot of reasons to feel unsettled about the economy, retailers best able to demonstrate value by offering compelling prices on quality merchandise are the ones that will emerge as winners.

Sustainability: Even if Al Gore arrived at the Academy Awards in a Hummer, returned the Oscar he won for “An Inconvenient Truth” and denounced global warming as an elaborate hoax, it wouldn’t derail the seismic shift that has taken place regarding sustainability and the retail industry. Retailers have gotten a taste of the supply chain efficiency benefits that come from viewing their operations through the lens of sustainability, and now that a business case has been established for saving the planet, look for industry leaders to push the envelope on sustainability initiatives at an even more aggressive pace.

Health care: As a hot button issue for the presidential election, this subject will be debated extensively and there are sure to be proposals put forth with serious implications for the profitability of the retail industry. If retailers speak with a common voice on this issue, they can be part of the solution and avoid being saddled with a system that increases their costs, but does little to address the inefficient processes and outdated systems that are key contributors to rising costs and a source of frustration for providers, payors and patients.

Private brand growth: The increased penetration of private brands is not a new phenomenon, but it is certainly one that shows no signs of slowing thanks to their margin-enhancing benefits. In fact, with retailers eyeing tough market conditions for 2008, the allure of direct sourcing will result in an acceleration of the trend. The capabilities of retailers’ internal product development teams have improved, but building a brand from scratch is never easy, so a more preferable strategy involves acquiring an existing brand or entering into an exclusive distribution agreement.

Authenticity: The Internet has created an environment where anyone with a digital video recorder is a potential investigative journalist capable of instantaneously communicating with the world. The implications for retail are such that dubious business practices are quickly revealed in cyberspace so the only option for retailers in an increasingly transparent world is to redouble efforts around the issue of integrity and assume that any information shared with employees or suppliers has the potential to be immediately shared with others who might interpret it differently than the sender intended.

Each of these issues, along with the obvious operational concern of expense control, promises to impact the retail industry in a big way this year. Companies with a strategy in place to address all, or even some, of them will improve their odds of achieving success given what is currently a fairly bleak outlook for overall economic growth.