It’s traditional versus alternative as regional, national lines blur

Arecent magazine article suggested that consumer packaged goods companies were scrambling to find alternative growth vehicles after Wal-Mart announced that it would scale back supercenter growth. But lamenting Wal-Mart’s demise as a market driver in food is quite premature, as a close look at the numbers in Retailing Today’s latest Annual Industry Category Census will tell you.

For starters, the article failed to quote a single CPG producer as saying that Wal-Mart was becoming less relevant to growth plans. Rather, it cited only a single consultant, who believed that it was preferable for major suppliers to pursue food retailers such as Costco, Target, Kroger and Supervalu over Wal-Mart. Given their growth, though, it would be more surprising to discover that the suppliers were solely fixated on Wal-Mart and weren’t pursuing opportunities with those food retailers.

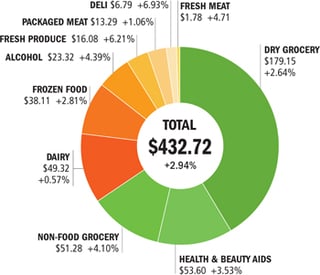

Food, HBC&Consumables| 2006 RETAIL SALES BY SUB-SEGMENT |

| %CHANGE OVER PREVIOUS YEAR, FIGURES IN BILLIONS |

| Source: Retailing Today estimates based on food statistics from ACNielsen for the 53-week period ended 12/31/06 |

| ALL FIGURES FOR U.S. OPERATIONS ONLY, UNLESS OTHERWISE NOTED |

| (): Decline or loss e: estimate |

Shaking a head or fist at Wal-Mart is an easy way to garner attention, but the fact of the matter is, Wal-Mart continues to dominate food retailing, and its growth outstrips anything in the market. Even by scaling back to between 190 and 200 new supercenters, as this year’s plans now call for, Wal-Mart will annually open as many supercenters as Target operates in total. With 200 new supercenters, the new stores alone will generate somewhere around $15 billion in sales, which would land them at No. 24 on Retailing Today’s Top 150 Annual Industry Report list. In other words, those 200 supercenters will constitute a larger food retailing entity than HEB, Wakefern or Albertsons.

It should be noted, when Wal-Mart’s management announced that it would scale back supercenter expansion, they shook up the retail community considerably, even temporarily driving up shares of supermarket stocks.

Top Volume Leaders (SALES IN MILLIONS)ALL FIGURES FOR U.S. OPERATIONS ONLY, UNLESS OTHERWISE NOTED Source: Top Volume data compiled from company reports, analysts’ estimates and Retailing Today research. (): Decline or loss e: estimate| CHAIN | 2006 | 2005 | %CHG. |

| Wal-Mart | $111,370e | $101,944e | 9.25% |

| Kroger | $57,712e | $53,472e | 7.93 |

| Supervalu | $37,406e | 34,763e | 7.60 |

| Safeway | $34,721e | 33,569e | 3.43 |

| Costco | $26,172e | 25,831e | 1.32 |

Still, the scope of the reaction seems somewhat exaggerated. Wall Street had, after all, been after Wal-Mart to pay more attention to measures that might boost the bottom line as a step toward bolstering an anemic performance by its shares. So, some action to leverage capital resources as a means of improving returns, productivity and sales from its stores in the United States can be regarded as consistent with market expectations and, as Wal-Mart’s management might anticipate, should rally analysts and investors around the stock. In October, Wal-Mart said it would open between 265 and 270 supercenters over the course of the current fiscal year, only to later scale that back to between 190 and 200. Over the next three years, Wal-Mart now says, it plans to open about 170 supercenters annually—a considerable number even if it is fewer than originally planned.

At the company’s annual meeting, Eduardo Castro-Wright, president and ceo of Wal-Mart Stores U.S.A., said that the retailer intended to pursue high-return opportunities “by focusing on markets where our customer segmentation approach offers the best opportunity to create a more competitive position for Wal-Mart and drive higher comparable-store sales. In addition, our U.S. plan includes a variety of initiatives designed to improve labor productivity and enhance margins.”

If new tactics prove effective, Wal-Mart may have fewer supercenters than anticipated come October, but it also may become an even more effective competitor in the 4,000 units it currently operates. Wal-Mart’s prowess in distribution and data management remain the standard for the industry. Even if Wal-Mart is opening fewer supercenters, the number of those units operating in the United States and, now, Canada, continues to grow.

In the United States, Target surpassed Meijer as the second-largest supercenter operator this year, although both chains continue to add combination units. Target’s grand opening schedule for this year—with 30 to 35 supercenters slated to bow—will put more SuperTarget units into operation than any other before it, Target Stores president Gregg Steinhaffel noted in a conference call earlier this year.

Now operating about 180 supercenters (with its first California SuperTarget preparing to open), Target also is gaining operationally by preparing its first-ever food distribution center in Florida, which should be up and running next summer. Long-time food distribution partner Supervalu will have a hand in steering it.

To put developments in the supercenter market in perspective, Meijer, with 176 supercenters, is the 24th largest retail chain in the United States by sales, according to Retailing Today estimates, while SuperTarget, as an independent entity, would rank at about 30. Only six supermarket operators—Delhaize America, Publix, Safeway, Ahold U.S., Supervalu and Kroger—generate higher sales than Meijer, and only seven (the six noted plus HEB) garner greater revenues than SuperTarget.

Meijer has become the most intense innovator among the supercenter operators, as evidenced this May with the opening of its first LEED certified “green” unit in Allen Park, Mich. The Allen Park unit uses construction and landscaping techniques to make it more environmentally friendly. The store serves as a good testing ground for the company in terms of deciding how to incorporate energy-saving measures and other green elements at new and renovated stores, Mark Murray, the company’s president, told Retailing Today. Meijer, for the time being, plans to leverage investments it has made in existing markets, including Chicago, Cincinnati and Detroit, in the immediate future, keeping its grand opening schedule modest for next year, but picking up the pace as the decade closes.

Developments in food retailing could spell big trouble for traditional supermarket operators that lack deep pockets. Research has shown that supercenters tend to drive out food retailers who have fewer economic resources than their competitors in a given market. The troubl