Affluent shoppers help drive Walmart's online grocery growth in first half of year

A specific demographic subset of Walmart customers helped the discount giant maintain strong online grocery sales in the first half of 2024.

A growing base of affluent households played a vital role in driving Walmart digital grocery growth through the first half of 2024 due to higher order frequency and spending than other customer segments, according to the "Profiling the Online Shopper: E-grocery Purchase Patterns in the U.S." report based on data from the monthly Brick Meets Click/Mercatus grocery shopping survey.

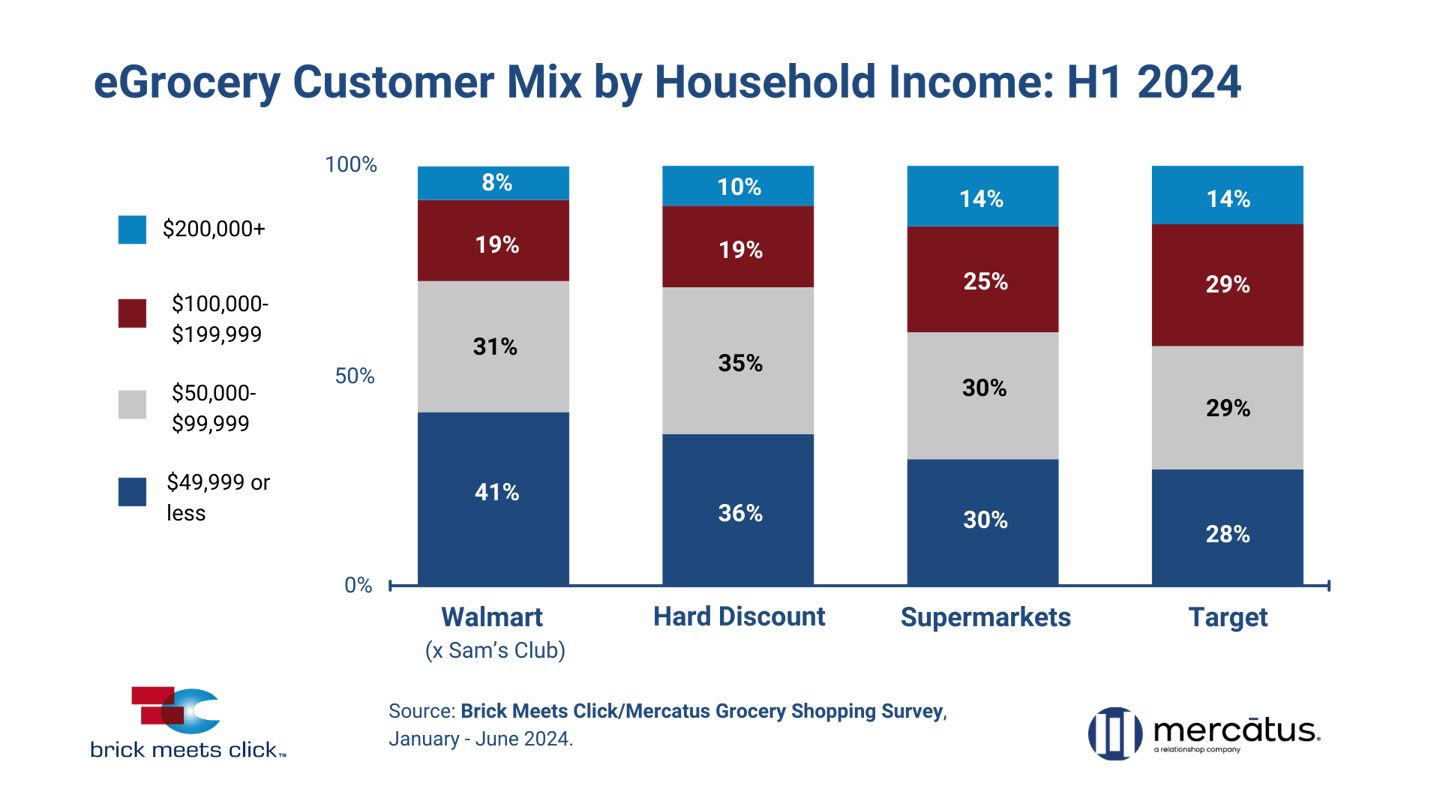

Looking at the e-grocery customer mix across the four major formats/banners analyzed by Brick Meets Click and Mercatus (Walmart excluding Sam’s Club, hard discount, supermarket and Target), the report still finds that Walmart’s grocery shopper base continues to skew more heavily toward lower income households than the other three segments.

During the first half of 2024, households making less than $50,000 annually accounted for 41% of Walmart’s average monthly active users, compared to 36% for hard discount, 30% for supermarkets and 28% for target.

However, Walmart’s most affluent segment, households with $200,000 or more in annual income, expanded to 8%, growing almost five times faster than the 4% year-over-year growth for its overall average monthly active user base.

According to the report, Walmart’s gains with affluent e-grocery shoppers also appear to have come at the expense of supermarkets, hard discount and Target, which each posted a decline in sales with this customer demographic.

In addition, overall average order values declined at the formats/banners in the analysis except for Walmart. Walmart’s overall average order value held steady year-over-year due to mixed results across income segments as its average order value for e-grocery orders placed by affluent shoppers surged more than 40% to $119 compared to the first half of 2023, while the average order value for its lowest-income users shrank by almost 6% to $84.

Order frequency dropped more than 10% for households making $200,000 or more per year to 2.02 monthly orders.

“Walmart’s growth in households making $200,000-plus per year shows that the ‘flight to value’ has even affected how this income group shops for groceries,” said David Bishop, partner at Brick Meets Click. “Affluent households that shop online for groceries at Walmart spend 1.5 times more each month than households in the lowest income bracket, making them a very attractive customer segment to target and win over.”

Other findings

- For households making less than $50,000 annually, Walmart’s sales dipped 6% and supermarkets and target dropped 20%, respectively.

- Overall, e-grocery order frequency rates at Walmart increased slightly in the first half of 2024, inching up by about a half of a percentage point to 1.97 monthly orders from the same period in 2023.

"Regional grocers risk losing more of the business that’s driven by affluent customers to Walmart if they don’t effectively address shifting expectations," said Mark Fairhurst, chief growth officer at Mercatus. "To retain existing affluent shoppers and possibly attract others, grocers need to strengthen their value propositions by offering unique products, personalized promotions, exceptional service, and enhanced digital experiences that elevate customer satisfaction."

[READ MORE: Walmart breaks record with Q2 online grocery share]

The monthly Brick Meets Click/Mercatus Grocery Shopping Survey is an independent research initiative created and conducted by Brick Meets Click since March 2020 and sponsored by Mercatus. This analysis is based on 10,529 responses compiled during January – June of 2023 (first half of 2023) and 10,501 responses compiled during January – June of 2024 (first half of 24) from adults 18 years and older who participated in the household’s grocery shopping.