Placer.ai: Mall visits stabilize in October

After a slight decline in September, mall visits rebounded to 2023 levels in October, and even increased at the tail end of the month.

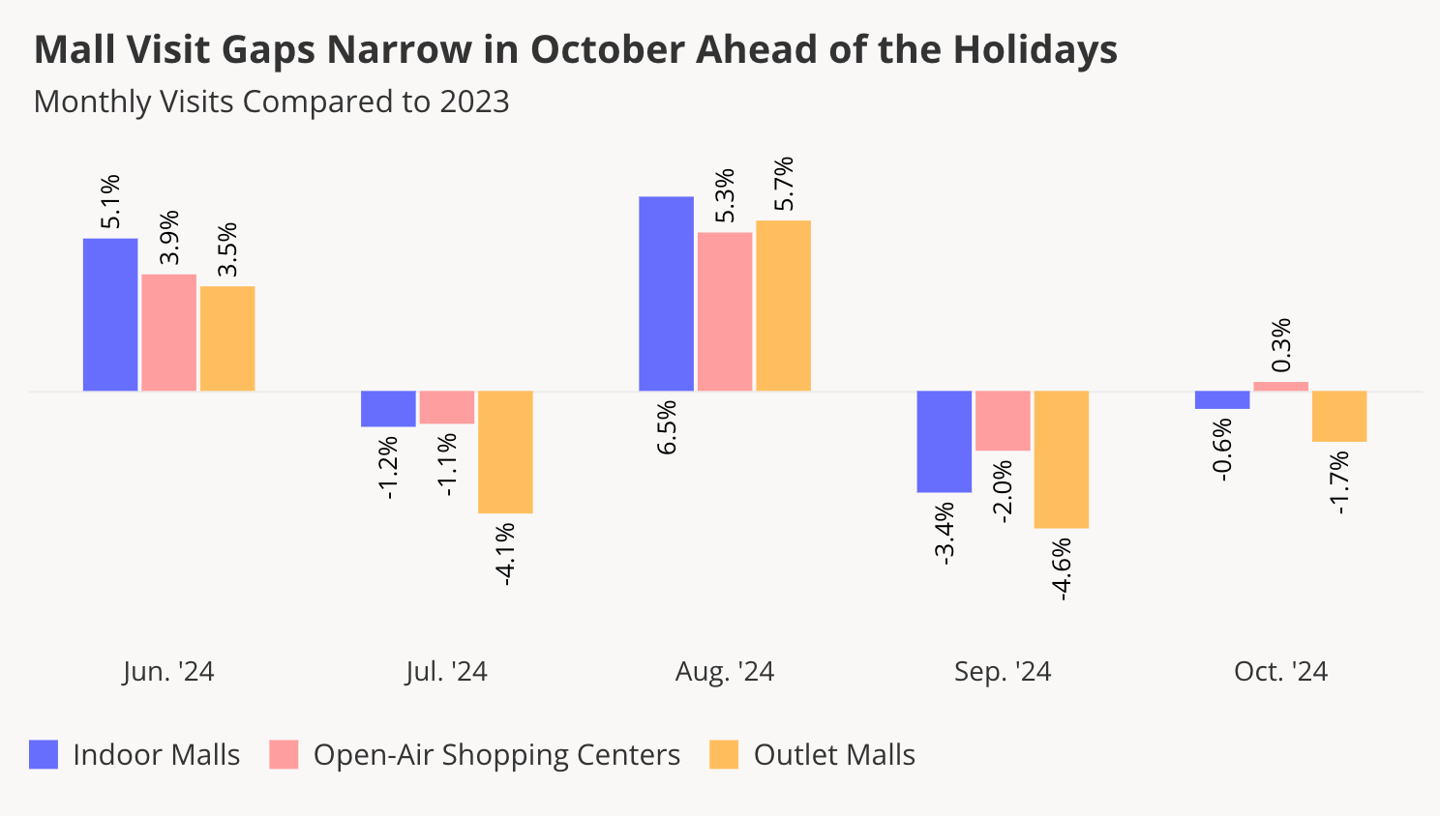

That’s according to retail analytics firm Placer.ai’s Mall Index for October 2024, which showed that mall traffic stabilized after a June and August that saw visits increase year-over-year and a July and September that saw visits dip year-over-year. For October, visits to indoor malls decreased 0.6%, and visits to outlet malls dipped 1.7%. Visits to open-air centers in October increased 0.3% compared to 2023.

“The closing of the year-over-year visit gaps may indicate that consumers are once again ready to spend following the brief September slow-down – boding well for the upcoming holiday season,” said Placer.ai content manager Shira Petrack.

[READ MORE: Yelp: Dining and experiences, not retail, driving mall visits]

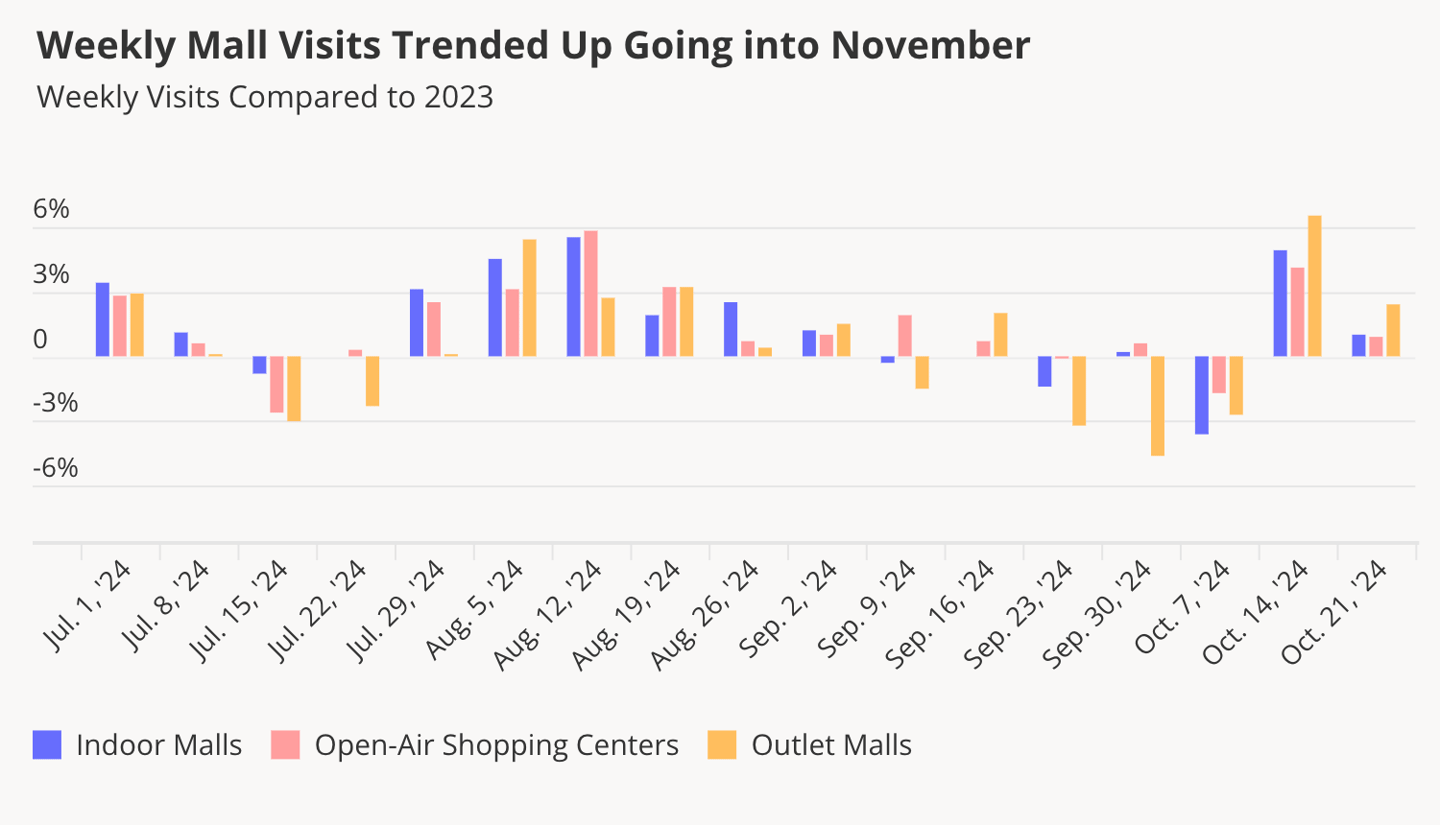

Looking at weekly trends in October offers even further reasons for optimism, according to the latest report. Year-over-year visits over the last two full weeks of October were positive for all three mall categories, with outlet malls in particular seeing the largest increases. During the week of Oct. 14, indoor mall visits rose 4.9%, open-air center visits rose 4.1% and outlet mall visits increased 6.5%.

“Outlet malls’ positive performance during the second half of the month may signal a comeback for the format, which has generally lagged behind indoor malls and open-air shopping centers in recent months,” said Petrack.

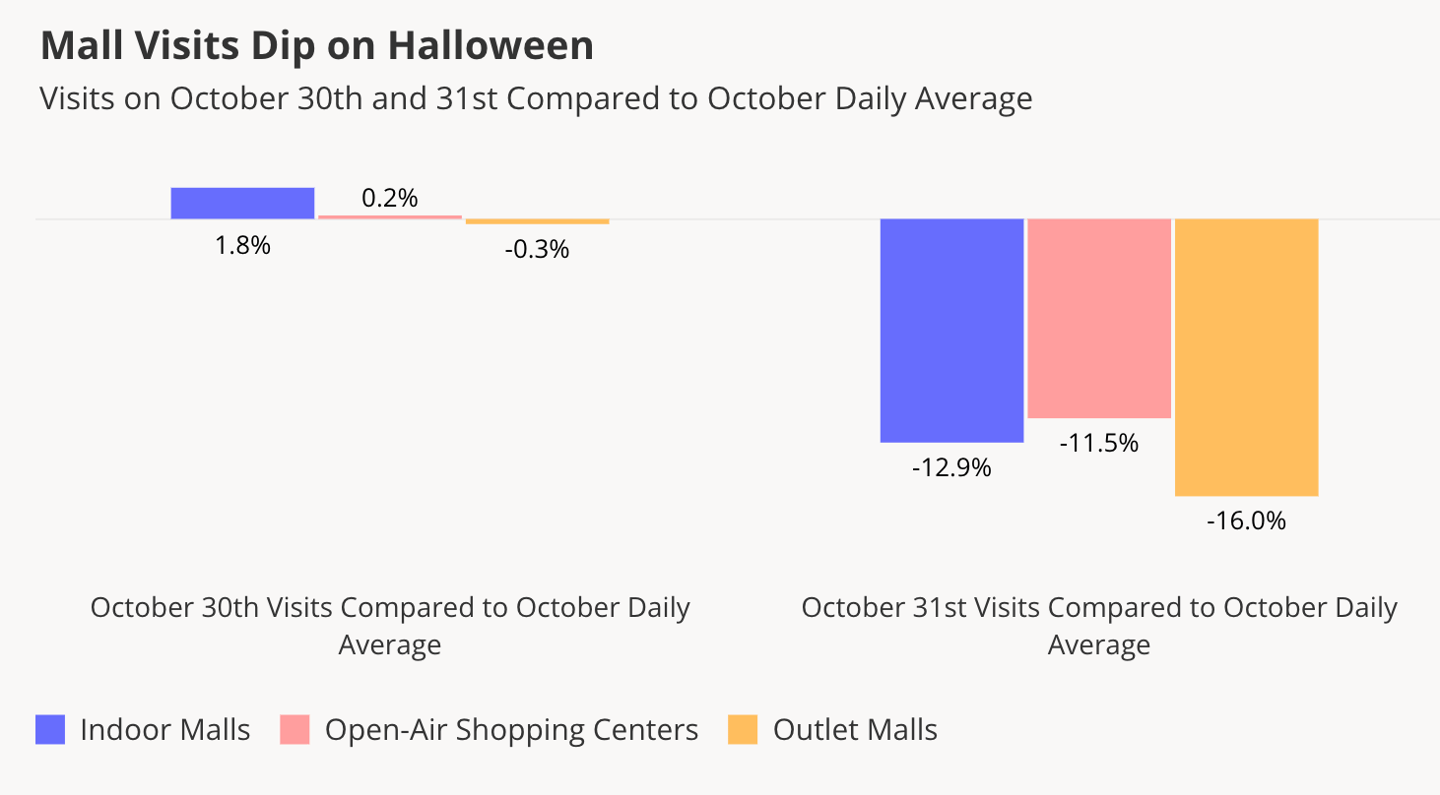

The mall sector didn’t see a visit increase on or around Halloween this year. Analyzing daily visits reveals that Oct. 30 visits were on par with the daily October average, while Oct. 31 traffic decreased across the three mall formats. Placer.ai said that the 13.4% total decrease in visits on Halloween is likely due to shoppers putting off their mall trips and instead choosing superstores and specialty retailers such as party supply stores and liquor shops for their holiday needs.

Placer.ai’s monthly Mall Index analyzes data from 100 top-tier indoor malls, 100 open-air shopping centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas.