Placer.ai: Coffee chains see increased traffic to start 2024

Americans can’t get enough coffee, and several leading chains are seeing store visits rise so far this year.

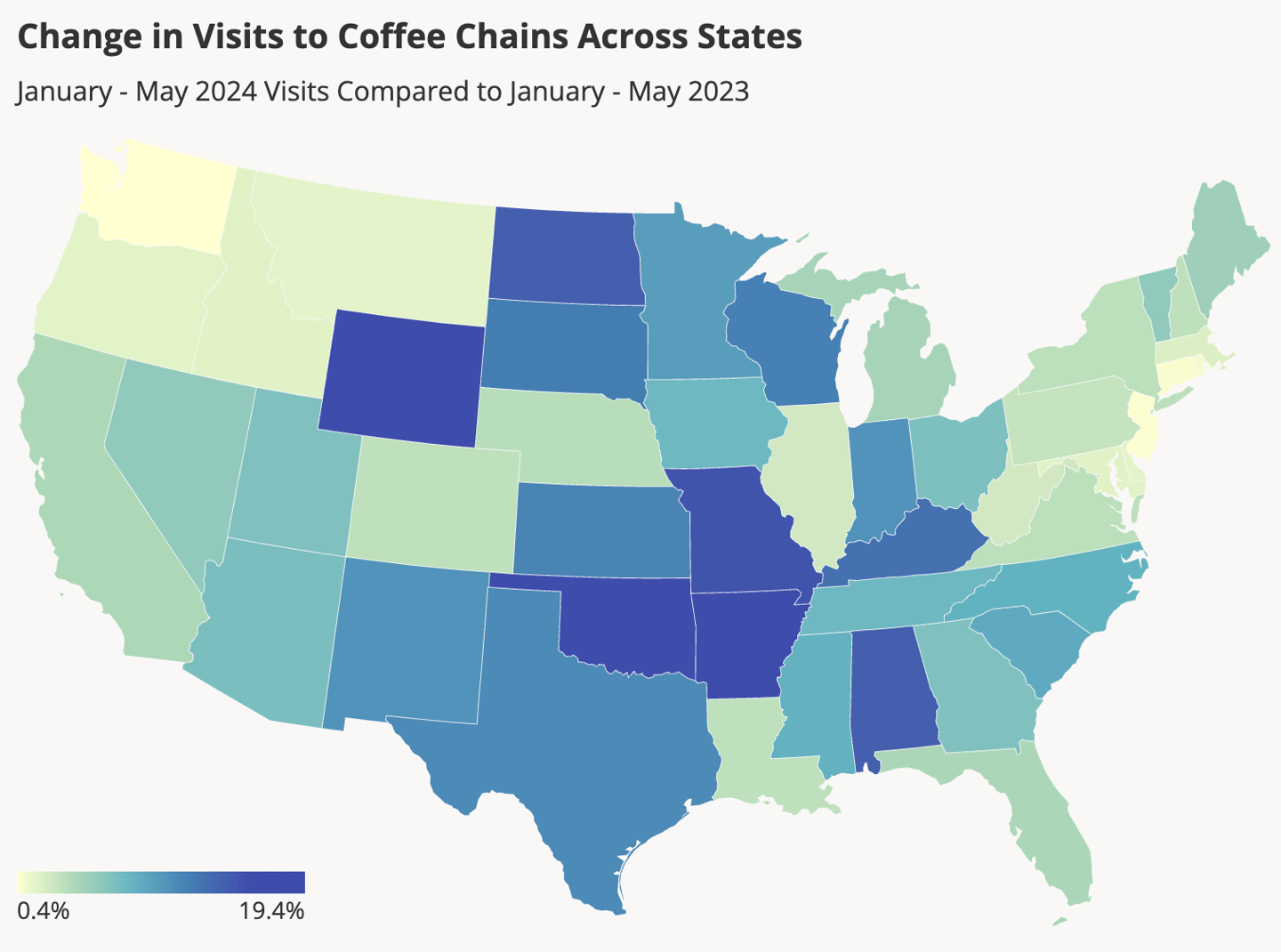

According to the latest report from retail data firm Placer.ai titled “Brewing Success: Winning Strategies for Coffee Chains,” year-over-year visits to coffee chains increased nationwide from January to May of this year, with every state in the continental United States experiencing visit growth.

The most substantial foot traffic boosts were seen in smaller markets like Oklahoma (19.4%), Wyoming (19.3%), and Arkansas (16.9%), where expansions may have a more substantial impact on statewide industry growth. The nation’s largest coffee markets, including Texas (10.9%), California (4.2%), Florida (4.2%), and New York (3.5%), also experienced significant year-over-year boosts in traffic.

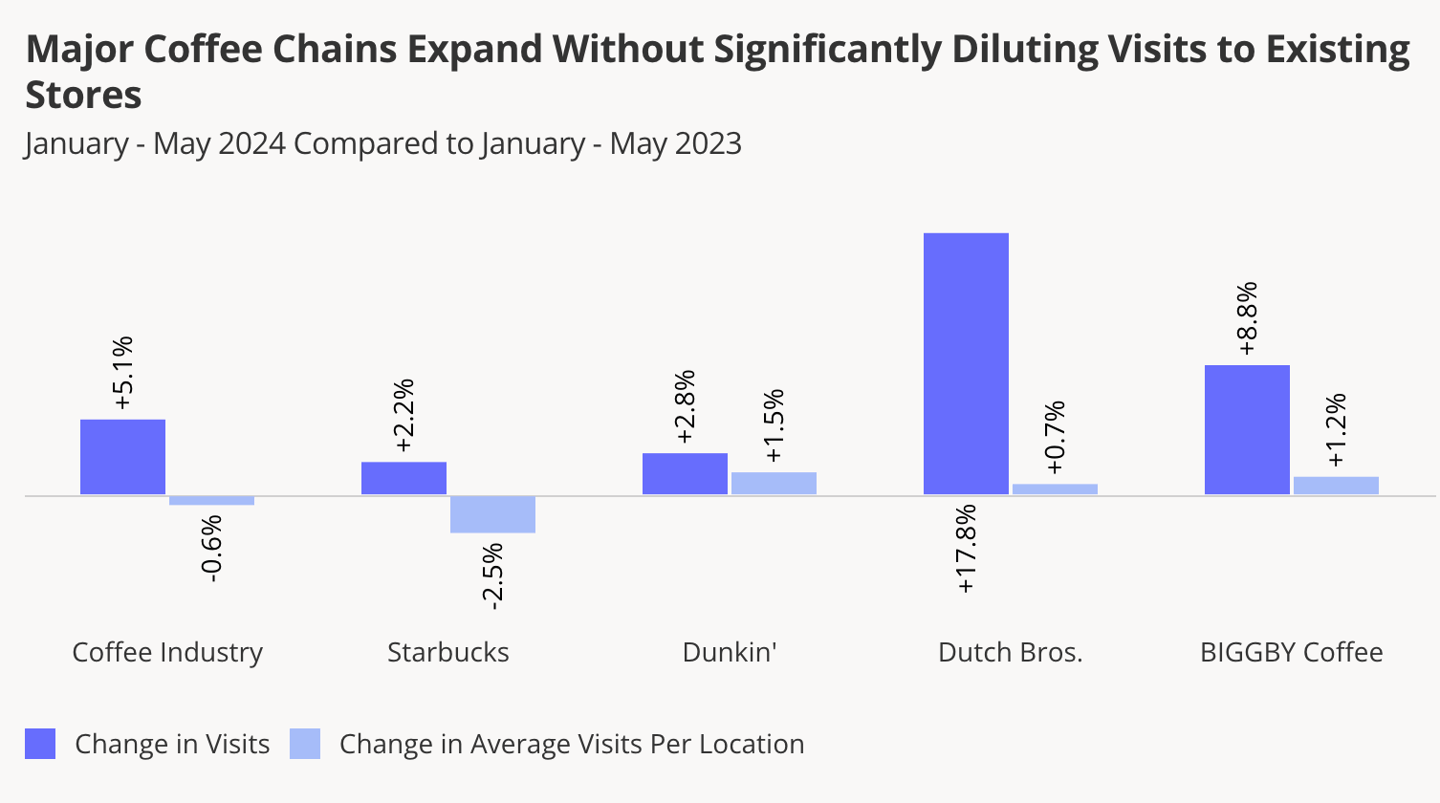

“The nation’s coffee visit growth is being fueled, in large part, by chain expansions,” said Placer.ai in the report. “Major coffee players are leaning into growing demand by steadily increasing their footprints. And a look at per-location foot traffic trends shows that by and large, they are doing so without significantly diluting visitation to existing stores.”

On an industry-wide level, visits to coffee chains increased 5.1% year-over-year during the first five months of 2024. Over the same period, the average number of visits to each individual coffee location declined just slightly by 0.6% – meaning that individual stores drew just about the same amount of foot traffic as they did in 2023.

When broken down by coffee chain, Dutch Bros. saw by far the largest increase in visits compared to the first five months of 2023 at 17.8%. Biggby Coffee saw significant gains as well at 8.8%, while Dunkin' (2.8%) and Starbucks (2.2%) experienced small increases.

Placer.ai notes that each chain has a different reason for its success. Dutch Bros. does particularly well in metro areas with higher proportions of one-person households, while Biggyby top locations draw greater shares of suburban population segments.

Dunkin’ is benefiting from customers on the go. Between January and May 2024, chain’s drew higher shares of very short visits (i.e. those lasting less than five minutes). Meanwhile Starbucks visit growth is being fueled by the return to office, according to Placer.ai. In early 2024, Starbucks visitors were more likely to proceed to their workplace following a coffee stop than in 2022 or 2023, and a greater share of early-morning visits lasted less than ten minutes.