Online grocery sales in big drop in February

Online grocery sales in the U.S. totalled just under $8 billion in February, a sizable decrease year-over-year.

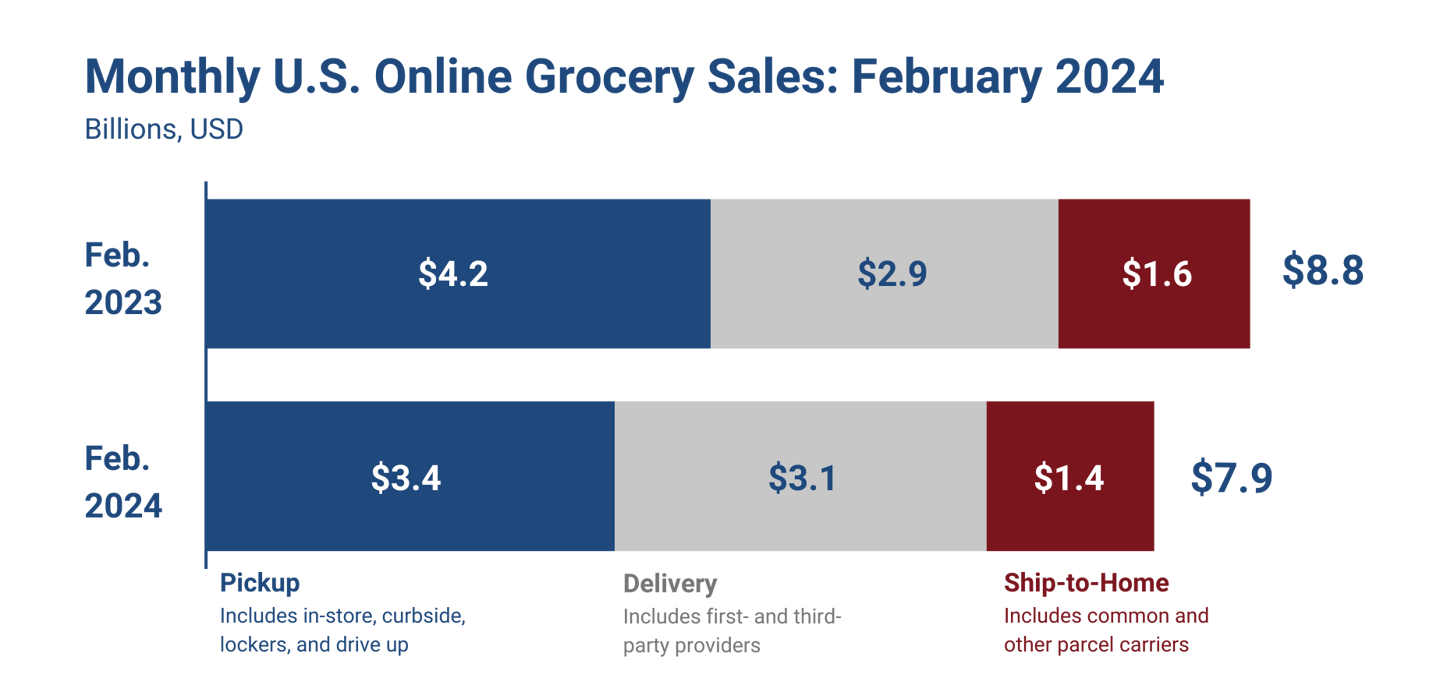

According to the most recent Brick Meets Click/Mercatus Grocery Shopper Survey fielded Feb. 28-29, e-commerce grocery sales decreased 10.5% compared to February of 2023 and totaled $7.9 billion. The February numbers are also a decrease compared to January of this year, when online sales reached $8.5 billion.

The YoY decrease was credited to lower average order values (AOV). Ship-to-home grocery sales dropped 15.4% and pickup fell 12.8%. Delivery, the only method to expand sales, was up 4.7%, assisted by a strong rebound in monthly active users (MAUs) versus last year.

During February, the weighted AOV across all receiving methods decreased 10% YoY. Ship-to-home and pickup both fell 13%, while delivery shrank by 7% versus last year. Most retailers and formats also experienced lower AOVs versus last year to varying degrees. Walmart had a relatively small 2% drop in AOV for pickup and delivery orders versus last year, while the supermarket format reported a 15% drop AOV for pickup and delivery compared to February 2023.

Brick Meets Click noted that all three receiving methods expanded their respective MAU bases. The gains were driven by an increase in the share of MAUs who received orders via multiple methods during the month as the overall user base slipped slightly, down 30 basis points (bps) compared to the prior year. Delivery, however, posted a significantly stronger expansion than either pickup or ship-to-home due to easier comparisons versus last year.

“Convenience remains one of the primary motivations for shopping online for groceries, however, for some customers, cost considerations are now weighing more heavily on their decision on how to shop,” said David Bishop, partner at Brick Meets Click. “This means that the explicit costs associated with eGrocery services are more likely to impact how these customers grocery shop, whether that’s returning to in-store or shifting where they shop online.”

While the total volume of eGrocery orders was essentially flat on a year-over-year basis, Delivery’s strong performance offset the order volume declines experienced by the other two methods. The number of orders fell 7% for Pickup and 3% for Ship-to-Home versus last year. In contrast, the 13% jump in Delivery order volume during February was predominantly driven by the expansion of its MAU base compared to the prior year, rather than a jump in order frequency.

Due to the shifts in segment order volume and the overall declines in AOV, pickup’s share of online grocery sales decreased to 43.4% in February 2024, falling by 468 bps compared to last year. Meanwhile, delivery expanded its share by 570 bps, finishing the month with 39.3%. Ship-to-home ended February with 17.3% of online grocery sales, down 102 bps versus 2023.

The continued pressure on consumers’ purchasing power likely prompted the 170-bps increase in cross-shopping between grocery (which includes supermarket and hard discount) and mass last month, according to the analysis. During February 2024, more than 30% of households that bought groceries online from a grocery service also did so from a mass retailer’s service.

"Although regional grocers may not always be able to match the low prices offered by mass merchants like Walmart, they can capitalize on customer insights to refine their service offerings" said Mark Fairhurst, global chief growth officer at Mercatus. "By using data to understand customer behavior, regional grocers can personalize shopping experiences, offer targeted savings, and ultimately, provide value that goes beyond pricing. This strategic use of customer data is essential for regional grocers to differentiate their services and maintain customer loyalty in a highly competitive market.”

The Bricks Meets Click/Mercatus Grocery Shopper Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau.