Delivery propels online grocery sales to 16% increase in January

Online grocery sales saw a large year-over-year increase in January, even after a strong holiday season.

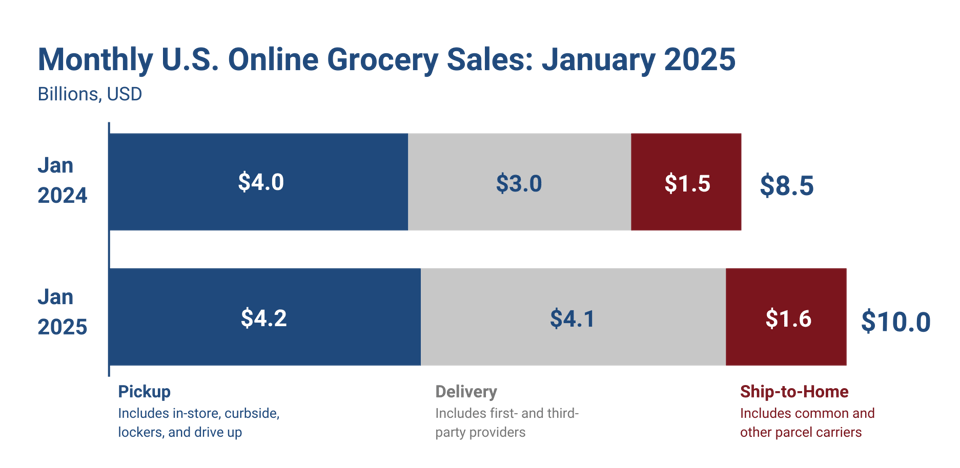

The U.S. online grocery market ended January 2025 with $10 billion in monthly sales, a 16.6% increase over last year as all three fulfillment methods posted year-over-year gains, according to the latest Brick Meets Click/Mercatus Grocery Shopper Survey. January marked the sixth-consecutive month of online grocery sales above $9.5 billion, which Brick Meets Click says was fueled in large part by the broad and deep discounts on membership and/or subscription programs.

Delivery’s year-over-year growth in January surged approximately 37% to $4.1 billion, as it continued to benefit from various promotional discounts on memberships and subscriptions that have continued since mid-2024, according to Brick Meets Click. Delivery posted an exceptionally strong expansion in its monthly active user base (MAUs), strong gains in order frequency, and a nominal increase in average order values (AOVs). This momentum helped delivery capture 610 basis points (bps) of sales share versus a year ago, to finish January with 41% online grocery sales.

“It’s important to call out that much of delivery’s explosive growth is driven by mass and specifically Walmart,” said David Bishop, partner at Brick Meets Click. “The ongoing waves of promotional tactics are having the intended positive impact on frequency and spend, and they are also increasing retention and share of wallet, which will make growth for their rivals more challenging going forward.”

Pickup sales grew 4% versus last year to $4.2 billion, driven by stronger AOVs, which offset a contracted MAU base and a drop in order frequency. Brick Meets Click says the headwinds facing pickup are due largely to the impact of the promotional efforts that are driving demand towards delivery. This has led pickup to cede 500 bps of sales share on a year-over-year basis to end January with 42% of online grocery sales, just slightly ahead of delivery.

[READ MORE: NRF: Retail sales fall in January, but show strong year-over-year gains]

Ship-to-home sales increased 9% in January compared to last year to $1.6 billion. Strong expansion of its MAU base and increased order frequency fueled the gains despite a year-over-year decline in AOV, according to Brick Meets Click. Ship-to-home continues to benefit to some degree from a “suboptimal” in-store shopping experience related to certain general merchandise and health & beauty care products being locked up to prevent theft. However, like pickup, Brick Meets Click says ship-to-home’s lagging rate of growth compared to delivery caused it to lose 110 bps of sales share compared to last year, ending January with 16% of all online grocery sales.

For cross-shopping, one-third of grocery’s MAU base also completed an order with a mass retailer sometime during January 2025, although this rate slipped 50 bps compared to the prior year. When it comes to the likelihood of reusing the same service within the next 30 days, grocery closed its gap with mass in January 2025 as grocery’s repeat intent climbed 600 bps year-over-year while the rate for mass remained unchanged versus last year. Grocery’s overall repeat intent gains were driven by improvements related to pickup orders as the mass format continues to maintain its lead for delivery orders.

“Delivery’s impressive growth has been driven by membership promotions, but shoppers can easily shift platforms depending on which factor matters most to them – price, product, or convenience,” said Mark Fairhurst, chief growth marketing officer at Mercatus. “Grocers that prioritize seamless experiences, deliver personalized offers, provide exceptional service, and implement compelling loyalty strategies will be best positioned for sustainable, long-term growth.”

While online grocery sales climbed significantly in January, overall grocery spending climbed just 2.5% versus last year. As a result, online grocery’s share of total grocery sales rose to 15% for January, up 180 bps compared to a year ago.

Brick Meets Click conducted the most recent survey on Jan. 30-31, 2025, with 1,691 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in January 2024. Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau.