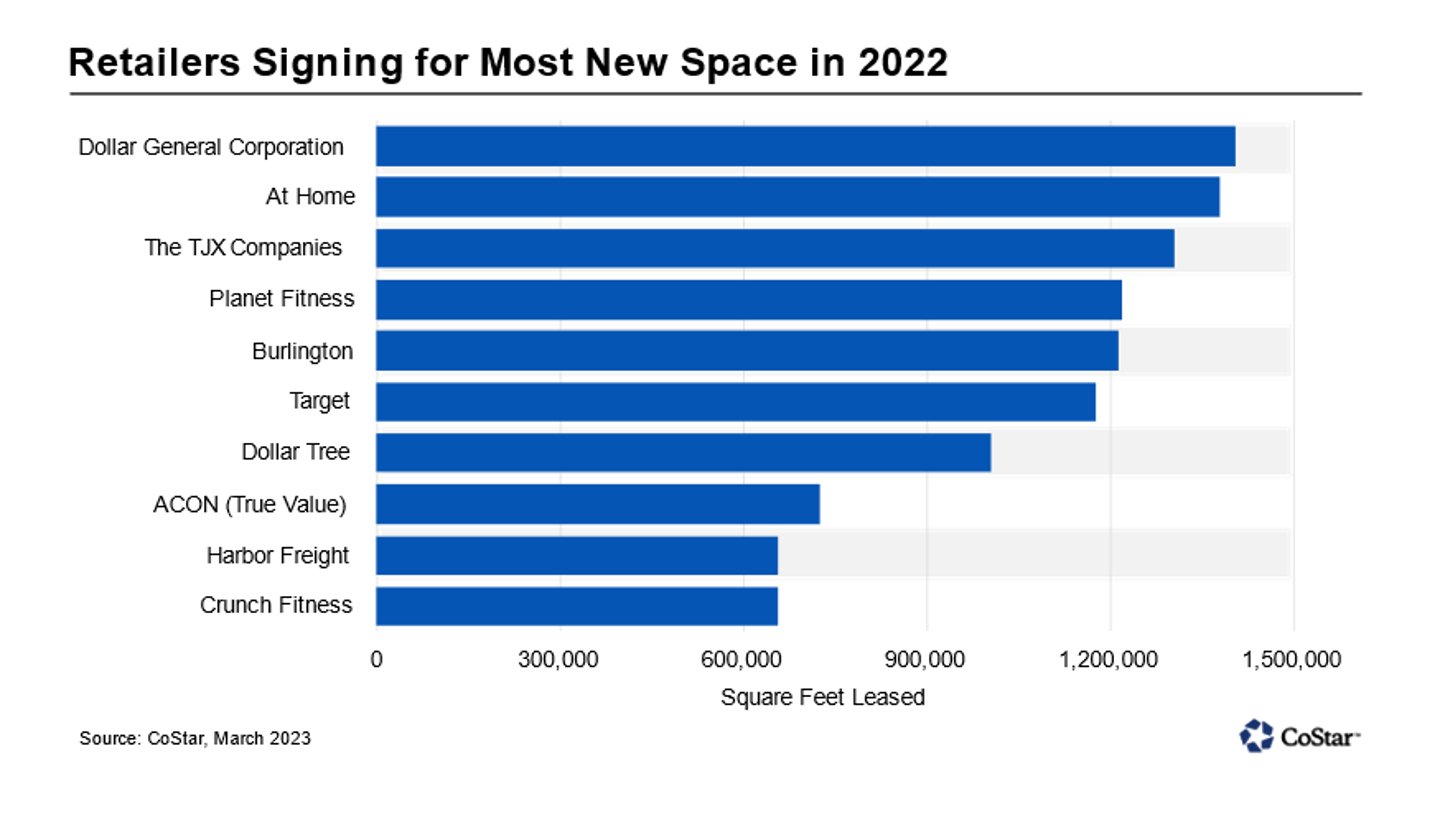

2022’s Top 10 Expanders: Dollar General No. 1

Discounters and value retailers were busy adding new square footage last year.

Dollar General, At Home, and The TJX companies all signed leases for more than 1.3 million sq. ft. of new space in 2022, positioning them as Nos. 1, 2, and 3 on CoStar’s Top 10 expanders list.

Retailers vying for prime spaces at a time when retail real estate absorption was at its highest level in five years also included gym chains Planet Fitness and Crunch Fitness and the home improvement retailer Harbor Freight, according to an evaluation performed by CoStar, a leading supplier of commercial real estate information.

All told, retail tenants occupied 250 million sq. ft of space nationwide.

“We have the tightest space markets we’ve followed since 2006. We’re still not building anything and we no longer have the large number of move-outs we saw happening pre-pandemic,” said Brandon Svec, CoStar’s national director of retail analytics. “From 2018 to 2020, we tracked 144 million square feet of store closures per year. In 2021 and 2022, combined closures totaled only 58 million sq. ft.”

Discount stores will stay on the growth track in the year ahead as consumers continue to seek out value to minimize inflationary pressures, CoStar predicted. Ever-active expander Dollar General has announced plans to open 1,050 new locations in 2023 and Dollar Tree is on course to open another 650.

Receipts have been buoyed at Dollar General due in part to the rapid growth of its new pOpshelf brand, and Dollar Tree has seen its profits rise from a shift towards higher cost merchandise.

Similarly well positioned for consumers’ pivot towards value are off-price retailers such as TJ Maxx and Burlington, both of which made the top five for new retail leasing activity in 2022. With inventory levels now re-established, both TJ Maxx and Burlington are eyeing continued expansion in the year ahead. TJ Maxx recently announced plans for 150 new stores will Burlington plans to open 75 net new stores in 2023.

Many of those stores will be smaller than might be expected, however. With square footage tight, value retailers are adjusting their footprints to do more with less.

“If you look at Burlington’s entire portfolio, the average store size is about 54,000 sq. ft.,” Svec said. “But when we did an analysis of their recent move-ins, we’re seeing a fair amount of stores ranging in size from the high 20,000s to the low 30,000s.”

Fitness centers, long undesired by co-tenants because their members took up too many parking space and did little shopping, are now desired by retail centers widening the breadth of their tenant curations.

“The spillover foot traffic in fitness was always a concern,” observed Svec, “but the category has come a long way in the last decade because of the diverse tenant types that have backfilled space, such as medical services and food and beverage.”

The home goods and home improvement sectors benefitted from the strong housing market during the pandemic, but both sectors are starting to soften due to high interest rates and home prices.

“Consumer appetite for housing goods will bear watching in the year ahead,” Svec said. “A considerable downshift in retailer sales could weigh on their near-term expansion plans.”